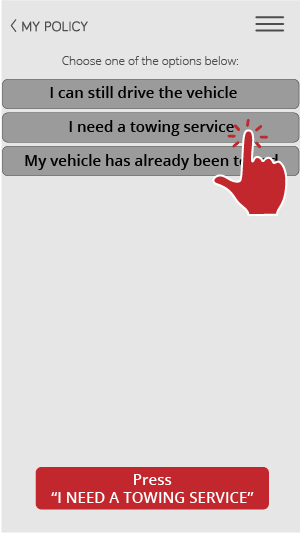

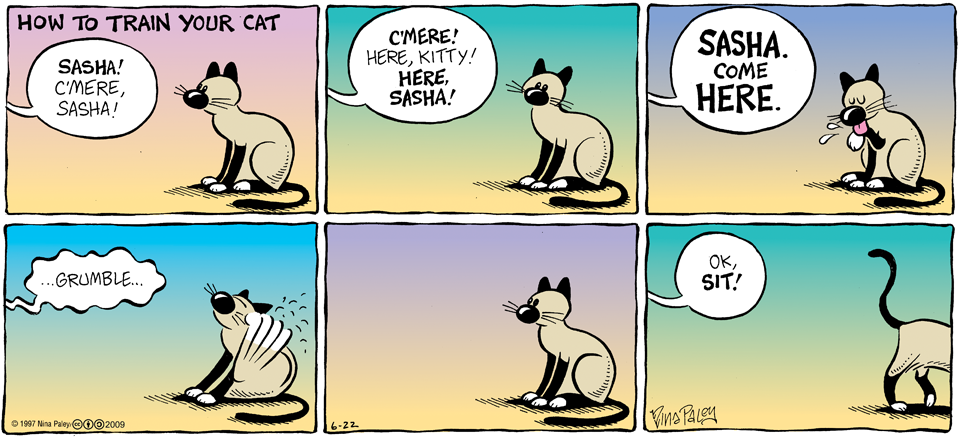

Have you been in an accident? Do you need towing? Now you can with the click of a button request a towing service that is Insurer approved and responds within seconds.

Anel explains the process step-by-step:

1. Press the “claim” button.

2. Press “I had a vehicle accident”.

3. Press “I need a towing service”.

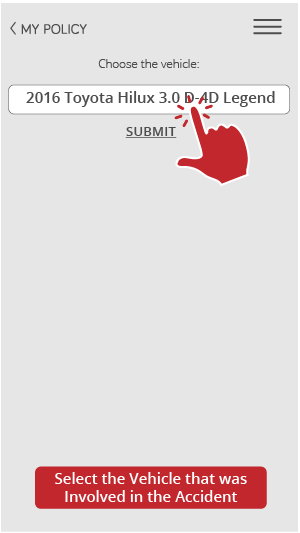

4. Select the vehicle that was involved in the accident.

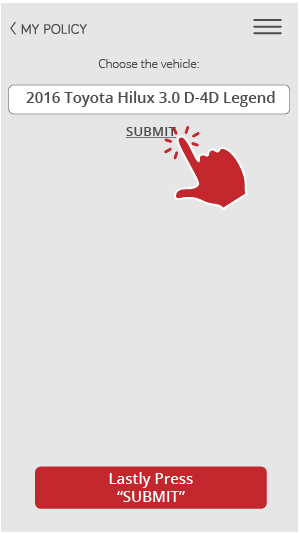

5. Lastly press “Submit”.

Voila! Help is on the way …

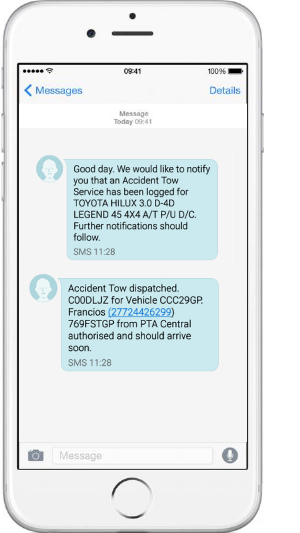

Within seconds your client will receive an SMS notification to say that HELP is on its way.

Shortly after the 1st SMS the client will receive another SMS to confirm the name and contact details of the towing company.

Misunderstandings regarding the excess payable on a policy

Many policyholders struggle to understand what an insurance excess is. They don’t understand why they have to pay this and especially how they can get their hands on these funds if they were not to blame for the accident resulting in the insurance claim! But let’s start at the beginning.

What is an excess?

An excess is the first amount payable by you in the event of a loss, and is the uninsured portion of your loss, so when you submit a claim you’ll have to pay an excess. It usually has to be paid to the garage fixing your car once it is repaired before you can drive it away.

Is my Insurer obliged to recover my excess?

In many cases the Insurer will want to recover its own outlay – that is the amount which it has had to pay its own insured, and it is entitled by virtue of a doctrine called subrogation to actually institute proceedings in the name of its insured against any negligent third party in order to endeavour to recover that outlay. The Insurer is however not obliged or bound by any regulation to do so. If your insurer does not wish to recover it’s outlay, then you have the right to sue the other driver for recovery of your excess, but if you do this you take the risk of the outcome of the case, and if you lose it, you may find yourself paying both sets of legal costs involved and not recovering any of your excess at all.

TEAM RALLY OF EPIC PROPORTIONS

At Legacy we believe that the strength of the team is directly equal to the strength of each individual. That is why we had a lively discussion at the Orient Hotel in Pretoria where we discussed the possibilities on how each of us can productively re-allocate our core roles and responsibilities towards the collective strength of our future Legacy Management Team.

We wish our new team the best of luck in achieving their goals.

Legacy would like to congratulate Margaret van Aswegen for her 10 years of loyal and dedicated service.

Quality of Information

Not too long ago Insurers only made use of the minimum information to rate and underwrite the risk of a policyholder. With the latest technology available, there have been an increased focus by Insurers to use more scientific data in order to rate a policyholder’s risk and therefore the quality of the policyholder’s information became more important.

The amendment of recent financial regulations (especially the Policy Protection Rules) and the commencement of the POPI Act which is imminent, the quality of information is not only a useful underwriting tool but has also become a regulatory requirement.

In this information age, organizations simply cannot afford to be without the quality information they need to effectively connect with policyholders and ensure that policyholders are correctly underwritten at a fair premium.

Some of the most important regulatory requirements to which all Insurers must adhere to, is the ability to be able to contact the policyholder and to know the risks they are underwriting.

The broker as the representative of the policy holder is the “first line of defense” to ensure that the quality of the information is correct and complete. It is therefore imperative that the broker must ensure that when interacting with the policyholder, the broker must obtain the latest and complete details of the policyholder and forward any updates to Legacy Underwriting Managers without delay. This information gets uploaded onto the Insurers’ data base on a continuous basis to ensure that they have the latest information available and comply with required regulations.

It is also very important that the broker must update their own information when they make any changes themselves, especially to their contact details. If you have recently made any changes to your business or your contact details, kindly send Legacy Underwriting Managers your latest details in order to ensure that we update your information accordingly.

The latest addition to our growing Art Collection:

“Granada Evening”

Robert Gwelo Goodman (1871-1939)

Size: 35,5cm x 45,5cm

The Legacy Call Center will always be ready to gladly assist you in need.

Post a comment